Asian Americans and the Holiday Shopping Season

Black Friday has been loosening its grip on American consumers in the last few years – instead, the year-end shopping season has been getting longer. Across categories, sales and promotions are now starting as early as early October, and the weekend before Christmas has emerged as the busiest time of year for certain retailers like Barnes and Noble. According to the National Retail Federation, holiday spending is expected to increase 2.5% to 3.5% to a total of $989 Billion in 2024. We would be remiss if we didn’t emphasize why Asian American consumers are a critical audience for brands during the most important selling period of the year.

Ever-growing $1.6 trillion buying power

Asian Americans’ buying power has been growing rapidly, projected to reach $1.6 trillion in 2024, according to the U.S. Bureau of Economic Analysis. This growth outpaces that of other ethnic groups, and is driven by factors like population expansion, high educational attainment, and rising employment levels. Asian American households spend about 11% more annually on retail than the average U.S. household, particularly in areas like consumer electronics and online shopping. Throughout their lifetimes, they will spend over $1 million more than the average U.S. household.

So…what are they buying?

Consumer electronics and tech continue to be a key focus of year-end shopping, especially given the traditions of Black Friday and Cyber Monday. Asians tend to be early adopters when it comes to the innovation adoption curve – research by Nielsen and Pew provide evidence that this demographic is often ahead of in adopting new technologies and trends. (Potential reasons point to high education levels, tech-forward cultures, and strong digital engagement, among others.) And this shows in their consumption.

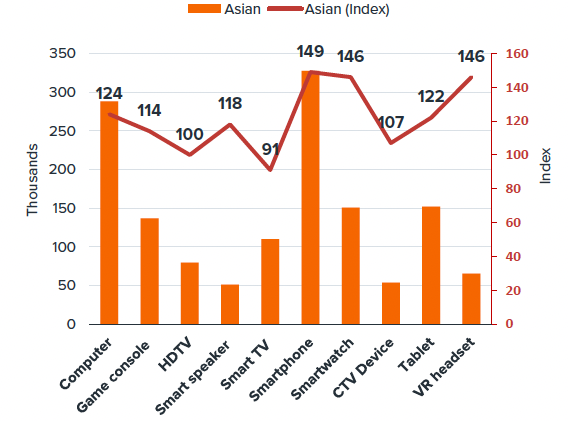

A study released by Claritas last year shows Asian Americans consistently over-indexing in key electronics and tech category spend. Over the past 12 months, the average Asian household has spent over $3,000 on consumer electronics, with an index of 174. Asian households are also most likely to have purchased TVs in the highest price range ($1,000 to $3,000 range) in the past 12 months. In terms of likely to buy items, smartphones, smart watches and VR headsets all over-index by nearly 50% versus other ethnicities. Add to this the well-known appreciation for value among this population, and you have an audience primed for engagement during the year-end shopping season.

Likely to buy in the next 12 months

Source: The 2023 U.S. Asian Market Report, Claritas

There’s more to holiday shopping than consumer durables

Electronics and tech are top of mind when we think Black Friday, but there’s another important category for Asian Americans. Two-thirds of the total Asian American population are foreign-born, that is, first generation immigrants. They have strong ties to their home countries, with family and friends back home. Many Asian Americans often travel back to Asia during the holidays, planning their trips way in advance of December. They are highly valuable consumers for the travel industry, especially considering these findings from the Claritas study:

- Asian Americans are likely to spend more money than average on airfare, hotel accommodations, and transportation.

- Asian Americans are more likely to fly on international airlines and book their travel online.

- They prefer luxury travel experiences, such as first-class or business-class flights, upscale hotels, and unique cultural experiences.

- Top vacation types are visiting family and friends, cultural experiences, and beach vacations.

- Top destinations for Asian Americans include Japan, China, South Korea, Hawaii, and various destinations throughout Southeast Asia.

Asian American consumers are a must win for the shopping season – and beyond

For many brands, the biggest barrier to engaging with Asian consumers seems to be the small perceived size of the market. But the fact that Asian American consumers have more to spend, are more brand loyal, and are looking for brands to engage with them in authentic ways means that brands who win with this group will not only win the holiday shopping season, but also lay the groundwork for a relationship with the fastest growing segment. Afterall, this is a group that is projected to replace Hispanics as the largest foreign-born population in the U.S. in the next few decades.